Florida Community Loan Fund 2013 Annual Report

Click here for a preview of the FCLF 2013 Annual Report.

Click here for a preview of the FCLF 2013 Annual Report.

Every day, our borrowers address urgent needs as they work to improve conditions in low-income communities across Florida. These critical needs range from offering safe, quality homes for low-income families to helping prevent homelessness for veterans; from transforming a life through education to providing healthcare where it is lacking. For more than 18 years, FCLF has provided both our financing and expertise to make their projects a reality.

Over this time, and as underscored in the past 5 years, we have learned that successful community development entities have mastered the art of balancing urgency with patience. Their determination, blended with patient capital, is exemplified in these two success stories.

Neighborhood Housing Services of South Florida – DuPuis Pointe, Miami. Over 5 years ago FCLF provided infrastructure financing to build affordable single-family hurricane-proof houses using Green standards. The collapse of the housing market stalled the development, yet NHSSF and FCLF remained committed to the project and waited for the right time to resume construction. Through patience and perseverance, in December 2012 NHSSF had presold 21 of 27 new homes and had completed the first 5 houses.

Neighborhood Renaissance - Westgate Homes, West Palm Beach. In 2007, FCLF approved financing for construction of single-family homes in this low-income neighborhood, with additional funding from county and state sources. FCLF's flexibility and commitment to the project allowed it to move forward, overcoming significant obstacles and delays. In October 2012, 5 years after the initial loan commitment, Neighborhood Renaissance held a ribbon cutting to celebrate 13 energy-efficient homes, the first of many to be built on what were once blighted lots with decaying houses.

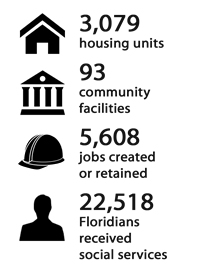

Our experience with Florida's community development needs and our willingness to remain a flexible and patient source of capital are key elements of FCLF's growth. As of June 30, 2013, FCLF has made 173 loans and 10 NMTC transactions to 109 borrowers through our three loan programs; to projects which have created 5,608 jobs and reached more than 22,000 Floridians. Other achievements include:

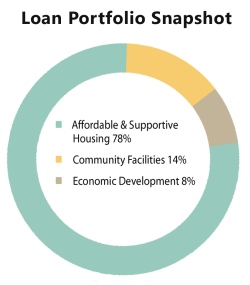

- Grew the loan portfolio to a record $19 million, increased total assets to $32 million, and net assets to $17 million;

- Expanded our successful New Markets Tax Credit (NMTC) program, gaining significant momentum with our fifth award of $40 million in allocation;

- Completed third CARS™ re-rating and maintained 2AA Policy+ rating;

- Continued our policy and advocacy efforts for both Federal and state community development issues. At the state level, our work led to the 2013 legislative passage of $150 million in funding for special needs programs;

- Engaged in Strategic Planning that will guide FCLF for the next 5 years; and

- Increased our marketing and branding presence, both online and through partnerships.

Click here to view or download a full copy of FCLF's 2013 Annual Report. Below are some highlights of the 2013 year in review: