Is my investment in the Florida Community Loan Fund tax deductible?

Both equity investments and contributions to FCLF’s general operations are tax-deductible. Debt capital investment or equity-equivalent investments are not. Financial institutions, however, can receive CRA investment and/or service test credit for either equity, equity-equivalent or debt capital investments. Contributions to FCLF’s general operations are tax deductible up to the limit of the law.

When will FCLF pay me interest on my investment?

Florida Community Loan Fund pays interest annually on June 30 of each year.

How can I be sure my investment is safe?

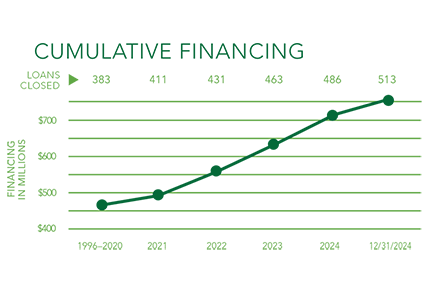

Florida Community Loan Fund adheres to underwriting and lending policies that ensure financial safety and soundness. To protect FCLF and its investors, it maintains a healthy loan loss reserve and through prudent growth of capital it ensures a safe capital position for investors. Historical loan loss experience is a good indicator of the quality of FCLF’s risk. Since inception in 1996 the organization has maintained an extremely low rate of loan losses. Please check with us for our current historical profile.

Florida Community Loan Fund maintains active registration as a charitable organization in the State of Florida, and is a qualified nonprofit organization under section 501(c)(3) of the Internal Revenue Service Code. FCLF annual financial audits are available to the public and on our website.

Charitable Organization Status.

Florida Community Loan Fund is a 501(c)(3) nonprofit organization, incorporated in the State of Florida. We are registered with the Florida Department of Agriculture & Consumer Services, registration number CH8044. A copy of the official registration and financial information may be obtained from the Florida Division of Consumer Services by calling toll-free 1-800-HELP-FLA (435-7352) within the state. Registration does not imply endorsement, approval or recommendation by the state.

FCLF is a 501(c)(3) nonprofit organization, as conifirmed by the IRS.

You may view our Florida charitable organization registration and our IRS 501(c)(3) confirmation from our Investor Resources website page .

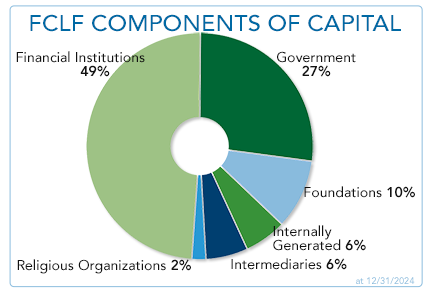

Who else supports FCLF?

Nearly all of Florida's leading banks, state and national foundations, many religious organizations and communities from across the U.S., and all seven of the Catholic Dioceses of Florida. You can see the full list on our Investors and Supporters website page.

Can I get my investment back?

Yes, upon maturity. All debt investments (essentially loans to FCLF) carry a specific term that is typically 3 to 10 years. FCLF will notify you by letter prior to the maturity date with options to redeem your investment or renew the investment for an additional term.