New Report Shows How Expired Federal Tax Credit Has Injected Billions of Dollars into Low-Income Communities

New Markets Tax Credit (NMTC) Creating Manufacturing Jobs in Areas with High Unemployment; Awaiting Congressional Approval to Continue

Washington, DC, June 6, 2012 — A report issued today by a coalition of community development organizations and financial institutions details how an expired federal tax credit, awaiting congressional action, has spurred private investment in economically distressed communities to finance a wide range of businesses, create jobs, and jump start local economies.

Washington, DC, June 6, 2012 — A report issued today by a coalition of community development organizations and financial institutions details how an expired federal tax credit, awaiting congressional action, has spurred private investment in economically distressed communities to finance a wide range of businesses, create jobs, and jump start local economies.

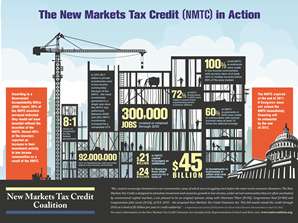

The New Markets Tax Credit (NMTC) was enacted in 2000 in an effort to stimulate private investment and economic growth in low income communities that lack access to the patient capital needed to support and grow businesses and create jobs. It does so by offering a modest incentive on investments made in economically distressed communities with poverty rates of at least 20% or median incomes at or below 80% of the area median.

The NMTC expired in December 2011 and is among a number of tax credits awaiting congressional renewal.

“There are distressed urban and rural communities throughout this country that have no access to conventional capital markets,” said Annie Donovan, president of the New Markets Tax Credit Coalition. “The Credit provides an avenue that directs private investment into areas that desperately need a shot in the arm. We’re seeing businesses created and revitalized, empty storefronts turned into community assets, and new jobs in communities that have been beset with chronic unemployment.”

The Coalition report presents key findings from their annual survey of the community development organizations that use the NMTC to create jobs and business opportunities in communities hard hit by the recession. The responding organizations reported that they made $2.3 billion in NMTC investments in 363 businesses in 46 states plus the District of Columbia in 2011. These investments financed a variety of businesses from commercial retail to “green” energy to community health centers to industrial manufacturing. The Coalition report also includes four NMTC success stories that illustrate how the NMTC has financed manufacturing businesses in urban and rural areas.

Importantly, said Ms. Donovan, Community Development Entities are making NMTC investments in some of the communities hit hardest by the recent recession, communities that continue to experience severe economic distress, evidenced by the fact that over 60 percent of NMTC investments made in 2010 went to communities with unemployment rates of at least 1.5 times the national average.

Extension legislation has been introduced in both houses to extend the NMTC through 2016. Senators Jay Rockefeller (D-WV) and Olympia Snowe (R-ME) introduced the New Markets Tax Credit Extension Bill of 2011 (S. 996) and Representatives Jim Gerlach (R-PA) and Richard Neal (D-MA) introduced an identical companion bill (H.R. 2655) in the House.

“We can’t have an economic recovery that overlooks whole swaths of the country,” said Ms. Donovan. “There are small, rural towns and neighborhoods in our largest cities that will not bounce back if we don’t have a way to incentivize investment in those communities. The NMTC has shown it can convert a modest amount of money into meaningful economic growth and job creation. Congress needs to keep the New Markets Tax Credit alive.”

“We can’t have an economic recovery that overlooks whole swaths of the country,” said Ms. Donovan. “There are small, rural towns and neighborhoods in our largest cities that will not bounce back if we don’t have a way to incentivize investment in those communities. The NMTC has shown it can convert a modest amount of money into meaningful economic growth and job creation. Congress needs to keep the New Markets Tax Credit alive.”

###

About New Markets Tax Credit

The New Markets Tax Credit was enacted in 2000 in an effort to stimulate private investment and economic growth in low income urban neighborhoods and rural communities that lack access to the patient capital needed to support and grow businesses, create jobs, and sustain healthy local economies. The NMTC is a 39% federal tax credit, taken over seven years, on investments made in economically distressed communities. Today due to NMTC, more than $45 billion is hard at work in underserved communities in all 50 states, the District of Columbia, and Puerto Rico

About New Markets Tax Credit Coalition

The NMTC Coalition is a national membership organization of Community Development Entities and investors organized to conduct research on and advocacy for the New Markets Tax Credit. The Coalition hosts two annual conferences and regularly publishes the NMTC Bulletin. To learn more, please visit www.nmtccoalition.org.