As we present our 2020 Annual Report we do so in the midst of a worldwide health crisis and elevated tensions at the national level. In many ways, our fiscal year was characteristically productive. Early in the year we unveiled a bold new strategy for FCLF, which. will guide the work of our organization through 2024 with a clear focus on our core purpose of lending and leading capital to maximize opportunities for people and places outside of the economic mainstream.

Then, with the onset of the global pandemic, quickly followed by the recognition that we must do better as a society to address long standing racial inequalities, the year became increasingly difficult – for the nation, for FCLF, and most importantly, for the people and communities we exist to serve. The economic and societal impacts caused by these events challenged us all, and we are doing our very best to respond.

FCLF acted in decisive ways to ensure that Florida’s community development infrastructure – including the hundreds of nonprofits and mission-aligned businesses that we have the honor of serving – is able to absorb the inevitable financial shocks in the midst of this recession. We took immediate steps by offering payment relief, creating new lending products, and gathering resources so that these organizations could continue to provide services and protect affordable housing for those outside of the economic mainstream.

Our top priority is that, collectively, Florida’s community development infrastructure comes out of these dual crises stronger than when we entered them. We are deeply thankful to our funders and investors, whose flexibility and generosity made it possible for FCLF to bring meaningful capital to address the current situation.

As we move forward into fiscal year 2021, a year that marks the 25th anniversary of FCLF’s first loan, we remain committed to working toward the social, political, and economic justice goals that our founders envisioned so many years ago. Today, our work toward achieving those goals is more challenging than ever, but we have never been more determined to use our capital and expertise to ensure a more dignified, just, and prosperous future to people and places that have traditionally lacked the same opportunities as the rest of society.

We derive our strength and resolve from the inspiring work of our borrowers. We are proud to share just a sampling of their stories in this year’s annual report, as these organizations and their projects serve as a beacon of light that capital, when focused on doing well, can have lasting impacts for Floridians and the communities in which they live.

Be safe.

Ignacio Esteban

CEO

Susan Leigh

Board Chair

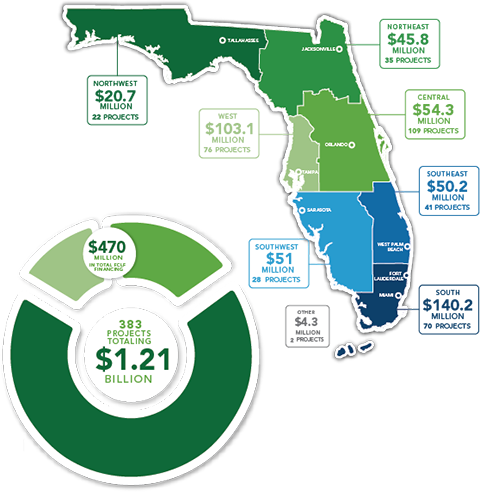

FOCUSING ON FLORIDA’S COMMUNITIES

Habitat for Humanity Greater Orlando & Osceola County

"Partnering with FCLF has allowed us to lower costs and maintain our construction schedule. In the long run, this partnership will help us serve more families, more efficiently.”− Catherine Steck McManus, President & CEO

A $500,000 construction line of credit from FCLF allowed Habitat Orlando & Osceola to build 10 new, single-family affordable houses, removing visual and economic blight and replacing it with newly constructed, resident-owned homes. By purchasing homes and becoming residents of the community, these new households also contribute to improving the local economy.

Jessie Trice Community Health

“We are proud to partner with FCLF on this project, which expands access to innovative, quality, comprehensive primary healthcare in our communities.”− Annie Neasman, President & CEO

With $9 million in NMTC allocation and $4.3 million in community development financing from FCLF, Jessie Trice Community Health System is building a new 15,000 square-foot clinic in Miami Gardens that will provide 13,000+ clients with medical, dental, mental health and pharmacy services – all on a sliding fee scale for the uninsured and under-insured.

Residential Options of Florida, ROOF

“When we visit our residents in their new home, we can already see the impact the funding is having, transforming the lives of adults with disabilities who, thanks to FCLF, Lee County, and ROOF, are now living independently, fully included in their community.”− Sheryl Soukup, Executive Director

With $500,000 financed through FCLF, ROOF purchased 2 houses, renovating them to provide 6 permanent, supportive homes, using a shared model that provides access to personal care, budgeting, and transportation services. The project provides a powerful impact for adults with disabilities who live in these homes

RESPONDING TO THE COVID-19 CRISIS

In March 2020, FCLF took immediate action and extraordinary steps to help our borrowers respond to the effects of the COVID-19 pandemic occurring across Florida. We focused on two main objectives:

- Ensure our borrowers could continue providing essential goods and services for the low-income clients they serve; and

- Protect Florida’s community and economic development infrastructure and prevent the catastrophic erosion of a system that took decades to build.

With these objectives in mind, we quickly developed and implemented the following COVID-19 relief tools:

- We eliminated late fees across our portfolio and offered 90-day payment deferrals to existing borrowers. Nearly 30% of the portfolio received this immediate payment relief.

- We developed and maintained a dedicated web page of COVID-19 resources specifically targeted to our borrowers.

- We designated $500,000 of FCLF’s own equity to seed a COVID-19 emergency working capital loan program, with a goal to grow the fund to $4,000,000. By fiscal year end we had raised an additional $1,000,000 and had deployed $700,000 in working capital loans.

- We dedicated significant staff resources to help Florida nonprofits access nearly $5 million from the federal Payment Protection Program (PPP) in collaboration with CDFI partner, Community Reinvestment Fund.

Most importantly, months into a pandemic that has no end in sight and continuing economic uncertainty, we remain committed and stand ready to support Florida’s low-income communities. We believe deliberate capital interventions will allow our borrowers – all of whom serve low-income people, many serving people of color – to continue providing essential goods and services, while also providing stability to survive the considerable financial impacts associated with COVID-19.

Our ultimate goal is to see Florida come out of this crisis stronger than when we entered it.

Examples of FCLF’s responsiveness to the impacts of COVID-19 on our borrowers are highlighted in the stories below.

Real Estate Education and Community Housing, R.E.A.C.H.

R.E.A.C.H. offers 2 programs for low-income households: financial and homeowner counseling, and homes for purchase that the organization has purchased and renovated. Often they can connect counseling graduates with affordable homes to purchase. COVID-19 forced the organization to cancel in-person counseling, bringing the business to a halt – yet R.E.A.C.H. needed to pay their employees while transitioning to online classes and awaiting PPP funds. FCLF promptly implemented two of our COVID-19 relief tools: 3-month payment deferral on a line of credit, and a permanent working capital loan of $137,500 through an expedited application and underwriting process. R.E.A.C.H. is now able to continue its educational services, place people in affordable homes, keep their employees on staff, and will emerge from this crisis stronger than before.

Habitat for Humanity of South Palm Beach County

COVID-19 meant many Habitat homeowners – restaurant, retail, and service workers – lost their jobs. This had a detrimental impact on Habitat for Humanity of South Palm Beach County’s income, much of which comes from homeowner mortgages – forcing a slowdown in the construction of new affordable housing communities for low- and moderate income homebuyers. Habitat SPBC reached out to FCLF for assistance, and we quickly provided a $50,000 loan at 0% interest. This COVID-19 emergency working capital loan was used for construction materials and subcontractor services to enable Habitat SPBC to continue to do what they do best – provide affordable housing where it is needed most.

Miracles Outreach CDC

Miracles Outreach CDC provides housing and services for children who are homeless, in the foster system, and survivors of abuse and human trafficking. When COVID-19 hit, the organization experienced rapid increases in payroll expenses, with paid staff stepping in and taking over duties of volunteers no longer able to donate their in-person services. As public schools closed, Miracles Outreach saw additional expenses for home-schooling activities, tutors, increased food and utility expenses, and enhanced cleaning and sanitation protocols. FCLF provided Miracles Outreach a 3-month deferral on existing loans, plus an emergency working capital loan of $50,000 at 0% interest through our expedited application approval and disbursement process. FCLF’s COVID-19 relief funding enables Miracles Outreach to continue to providing stability and care for vulnerable children.

FINANCIAL RESULTS 2020

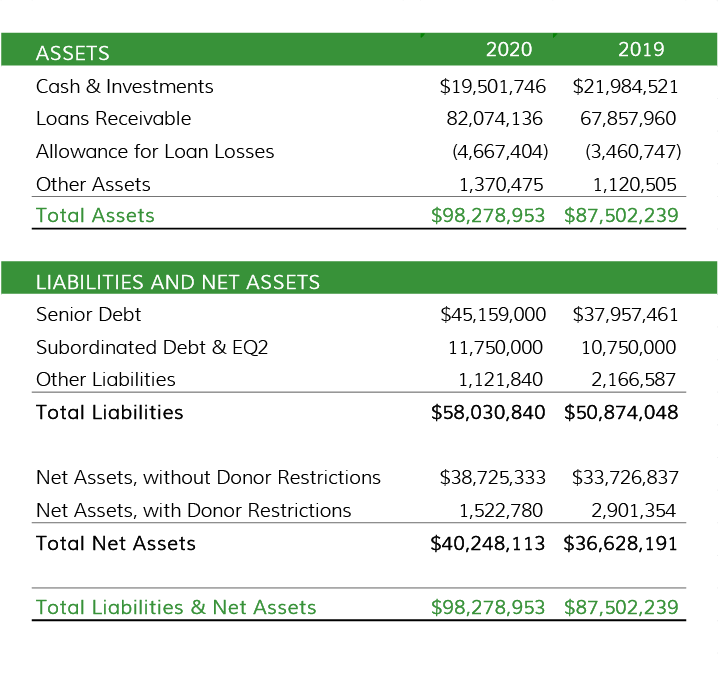

Summary Statement of Financial Position

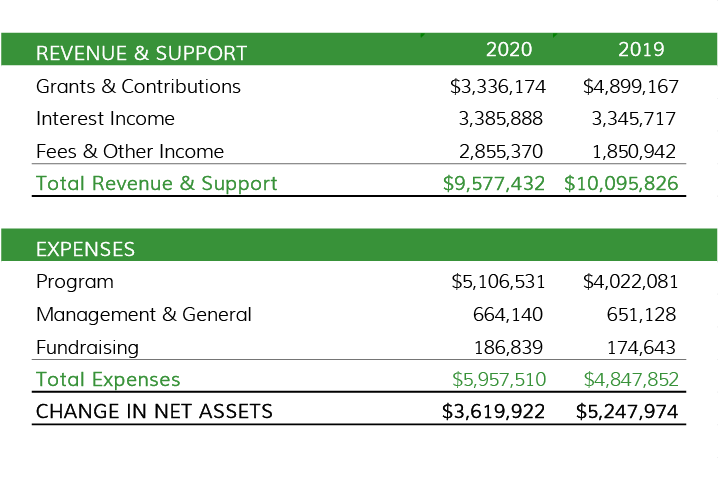

Summary Statement of Activities

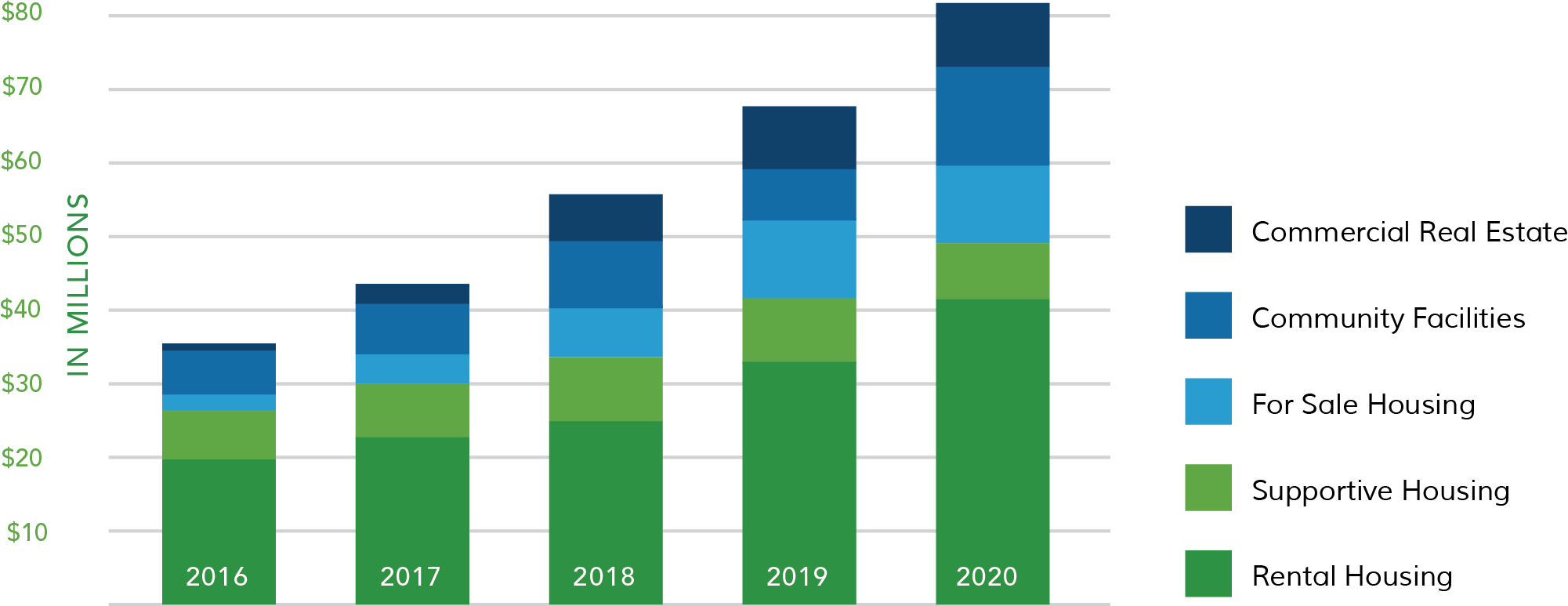

OUR IMPACT

INVESTORS AND SUPPORTERS

Special thanks to the many donors and investors who are making our COVID-19 relief efforts possible.

Religious Organizations • Adrian Dominicans • Archdiocese of Miami • Dignity Health • Diocese of Palm Beach • Diocese of Venice • Mercy Loan Fund • Mercy Partnership Foundation • Oblates of St. Francis de Sales • Our Lady of Victory Missionary Sisters • Religious Communities Impact Fund • School Sisters of Notre Dame (Maryland) • Sinsinawa Dominican Sisters • Sisters of Charity of Nazareth • Sisters of Charity of St. Elizabeth • Sisters of Providence • Sisters of St. Francis of Philadelphia • Sisters of the Blessed Sacrament • Sisters of the Holy Names of Jesus and Mary • Sisters of the Sacred Heart of Mary • Trinity Health

Financial Institutions and Corporations • Amerant • American Momentum Bank • Axiom Bank • Bank of America • BankUnited • BB&T • BBVA Compass • BMO Harris Bank • Carlton Fields Jorden Burt Law Firm • CenterState Bank • CIT Bank • Comerica Bank • Fifth Third Bank • First Republic Bank • Florida Capital Bank • HSBC Bank USA, NA • IBERIABANK • Mercantil Commercebank • Mutual of Omaha Bank • Northern Trust • PNC Bank • Raymond James Bank • Regions Bank • Sabadell United Bank • Seaside National Bank & Trust • SunTrust Bank • Synovus Bank • TD Bank • Third Federal Savings & Loan • TIAA Bank • Truist Bank • Trustco Bank • US Bancorp Community Development Corporation • US Bank, NA • Valley National Bank • Wells Fargo Bank

Foundations • Bank of America Foundation • Erich and Hannah Sachs Foundation • The Father's Table Foundation • Florida Blue Foundation • JPMorgan Chase Foundation • PNC Foundation • TD Charitable Foundation • Wells Fargo Foundation

Government Agencies • Community Development Financial Institution (CDFI) Fund of the U.S. Department of the Treasury • Florida Department of Agriculture and Consumer Services, Division of Food, Nutrition and Wellness

Nonprofit Organizations • Enterprise Community Loan Fund • Good to Grow Fund • Miami Homes for All • Opportunity Finance Network

Individuals • Anonymous (donations from two individual investors) • Matthew and Victoria Simmons

Includes investors and supporters for the last three years.

FCLF Board of Directors

Susan Leigh, Chair. Principal, The Community Concepts Group

Marilyn Drayton, Vice Chair. Community Relationship Sr. Manager, FL and SE Region, Wells Fargo Bank

Judith Rimbey, OP, Treasurer. Business Office Assistant, Cardinal Newman High School

Victor Rivera, Secretary. Senior VP, Business Banking Market Executive, Central Florida, Bank of America Merrill Lynch

Ana Castilla, Vice President, Community Development Manager, TD Bank

Jack Humburg, Executive VP, Housing, Development & ADA Services, Boley Centers, Inc.

Claire Raley, Senior VP, Community Development Officer, BankUnited, N.A.

Germaine Smith-Baugh, President and CEO, Urban League of Broward County

John Talmage, Director, Lee County Economic Development Office