"During this unprecedented time, it is critically important for Floridians to have access to affordable housing and essential needs." - Mel Martinez, JPMorgan Chase, Chairman of the Southeast U.S. and Latin America

JPMorgan Chase and JPMorgan Chase Foundation have partnered with Florida Community Loan Fund since 1998, providing operating support, equity grants, and investments to extend the reach of affordable housing in Florida's low-income areas. For example:

- FCLF COVID-19 Emergency Loan Program. JPMorgan Chase Foundation provided a grant that will help FCLF borrowers with financial options in the wake of loss of business due to COVID-19. (See detailed announcement below.)

- PRO Neighborhoods Award. JPMorgan Chase awarded the PRO Neighborhoods Grant to Florida Community Loan Fund and New Jersey Community Capital to increase affordable housing in Central Florida.

- South Florida Housing Link. JPMorgan Chase invested in a collaboration of five South Florida nonprofit organizations to improve access to affordable housing.

At FCLF, we exist to maximize opportunities for people and places outside of the economic mainstream. With partners like JPMorgan Chase, we can continue to reach underserved populations and strengthen communities across Florida.

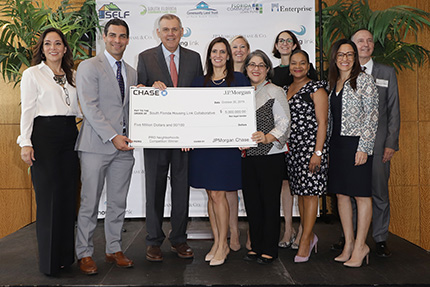

Pictured above: South Florida Housing Link award announcement on October 30, 2019, at the Black Archives Historic Lyric Theater in the Overtown area of Miami. Photo courtesy of JPMorgan Chase.

Below is an announcement from JPMorgan Chase on their May 2020 support of FCLF and community development in Florida.

JPMorgan Chase Commits $400,000 to the Florida Community Loan Fund to Support Affordable Housing and Provide Essential Needs for Florida Residents during COVID-19

JPMorgan Chase is making a $400,000 philanthropic investment in the Florida Community Loan Fund (FCLF) to help provide a financial buffer for nonprofit affordable housing providers supporting single-family and multi-family housing homeownership and rental properties during the COVID-19 pandemic. The funds will also help provide essential needs – including food access, healthcare and community facilities – for those living in Florida communities most vulnerable to loss of income.

FCLF quickly developed a working capital emergency loan program for its borrowers affected by COVID-19. The program offers low-cost, flexible emergency working capital to nonprofit and mission-focused for-profit FCLF borrowers and is one of several tools FCLF has developed to ensure community development organizations can expand services and stabilize as they respond to the crisis.

“Florida’s service sector dependent economy has been hit hard by COVID-19. Our focus during the pandemic has been to help support and stabilize the community development sector in our state,” said Ignacio Esteban, FCLF CEO. “We are deeply thankful to JPMorgan Chase, and to dozens of other partners, for supporting our efforts during these times.”

The investment from JPMorgan Chase is part of the firm’s $250 million philanthropic and business commitment to address the immediate and long-term challenges of the COVID-19 crisis. This week alone, the firm is deploying $35 million in new philanthropic investments in communities across the U.S. and around the world, with a focus on communities of color and vulnerable populations globally, to help them access much-needed financial and technical resources during the crisis and prevent the opportunity gap from widening as the economy begins to recover.

“During this unprecedented time, it is critically important for Floridians to have access to affordable housing and essential needs,” said Mel Martinez, Chairman of the Southeast U.S. and Latin America for JPMorgan Chase. “We are making immediate investments to help those most affected by humanitarian challenges and looking into sustainable and innovative solutions to help small businesses and underserved communities recover with the crisis subsides.”

According to the JPMorgan Chase Institute, 65 percent of families don’t have the cash buffer to weather a simultaneous income dip and spike in expenditure like the one resulting from the COVID-19 crisis. Median Black and Hispanic families earn roughly 70 cents in take-home income for every dollar earned by White families. Racial gaps in liquid assets are twice as large. 50 percent of small businesses in the U.S. have less than 15 cash buffer days, meaning many small businesses are especially vulnerable in this environment.

JPMorgan Chase has collaborated with the Florida Community Loan Fund since 1998, providing operating support, equity grants and investments to extend the reach of affordable housing in Florida’s low income areas. In the last three years, the firm has invested more than $10 million in FCLF to increase affordable housing in Central Florida, and improve access to sustainable affordable housing near South Florida’s transit corridor.