Regions Foundation and Florida Community Loan Fund: Supporting businesses impacted by COVID-19

Florida Community Loan Fund is working with Florida nonprofits and mission-focused organizations during the COVID-19 pandemic to ensure they can continue to provide services to people and places outside of the economic mainstream. FCLF is offering loan relief and special emergency assistance to our current borrowers, and helping Florida nonprofits with their Paycheck Protection Program loan applications through the SBA. This COVID-19 relief and assistance is made possible by support from many, including Regions Foundation.

Below is the text from Regions Foundation’s announcement. The full update can be viewed here.

Regions Foundation Announces Grants for Branches and Florida Community Loan Fund in Support of COVID-19 Response

Branches and FCLF are serving businesses impacted by the coronavirus.

Branches and FCLF are serving businesses impacted by the coronavirus.

By Jeremy King

BIRMINGHAM, Ala. – April 30, 2020 – The Regions Foundation on Thursday announced the latest in a series of grants to support nonprofit organizations that are helping small businesses impacted by COVID-19. The Regions Foundation is a nonprofit initiative of Regions Bank that supports community investments.

Two nonprofits in Florida are among those receiving grants in this latest installment:

- Branches: A nonprofit focused on helping working families and their children break the cycle of generational poverty, Miami-based Branches is using a virtual coaching model to help micro businesses facing financial challenges due to the virus. This is in addition to student services and financial wellness opportunities sustained by Branches amid the pandemic. Branches is receiving a $40,000 grant from the Regions Foundation.

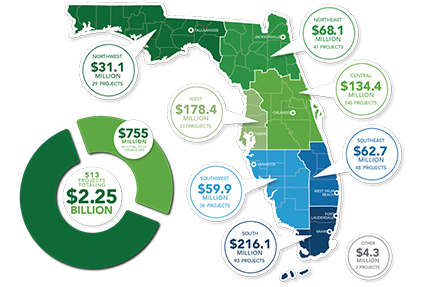

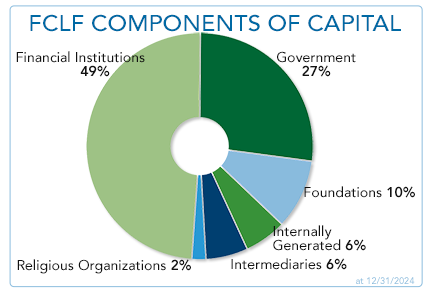

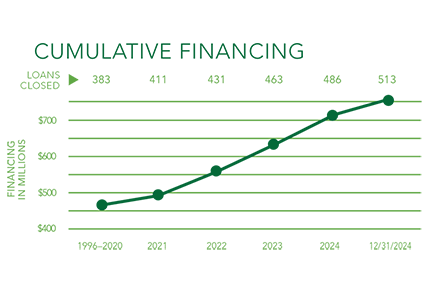

- Florida Community Loan Fund: Florida Community Loan Fund is a nonprofit, multifaceted financing entity with a 25-year history of providing flexible capital and expertise to nonprofits and mission-aligned for-profits serving people and places outside the economic mainstream across Florida. FCLF is nationally recognized for its work as a certified Community Development Financial Institution (CDFI) and Community Development Entity (CDE) through the U.S. Dept. of Treasury and as a member of the Federal Home Loan Bank of Atlanta. FCLF is receiving a $55,000 grant from the Regions Foundation.

“With so many newly unemployed in our community due to the COVID-19 pandemic, small businesses are struggling to make ends meet as revenue has plummeted in so many industries and sectors,” said Brent McLaughlin, Executive Director of Branches. “The Regions Foundation grant will enable us to provide technical assistance and offer critical grants to help hundreds of small businesses navigate these uncertain times.”

“During the COVID-19 pandemic, FCLF is committed to helping hundreds of organizations statewide rise to the challenge of serving those outside of the economic mainstream,” added Ignacio Esteban, FCLF CEO. “The grant from the Regions Foundation allows us to continue to provide critically needed capital to nonprofit and mission-focused for-profit borrowing organizations as they provide housing and essential social services to those who need it most.”

“Nonprofits such as Branches and FCLF are providing vital assistance to small businesses to help them through this extremely difficult time,” said Marta Self, Executive Director of the Regions Foundation. “The Regions Foundation is proud to support this work as part of our commitment to help communities during this crisis, and we will continue to identify more avenues for community support as we move forward.”

The grants announced by the Regions Foundation on Thursday are in addition to grants announced on April 24 for several Community Development Financial Institutions. The Foundation also announced recently that it will match donations by Regions Bank associates to United Way organizations and Community Foundations responding to COVID-19 needs.

Also, Regions Bank has issued financial support to a variety of additional nonprofits, and the bank recently donated a series of advertisements to food banks as well. Through that donation, advertisements originally purchased by Regions to promote bank services were instead given to food banks to encourage viewers and readers to financially support food bank services during the crisis.

Separately, Regions Bank continues to offer a series of options for customers suffering financial impacts from COVID-19. Additional information on Regions Bank resources can be found at www.regions.com/coronavirus.

About Regions Foundation. Regions Foundation supports community investments that positively impact the communities served by Regions Bank. The Foundation engages in a grantmaking program focused on priorities including economic and community development; education and workforce readiness; and financial wellness. The Foundation is a nonprofit 501(c)(3) corporation funded primarily through contributions from Regions Bank.

About Regions Financial Corporation. Regions Financial Corporation (NYSE:RF), with $133 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates approximately 1,400 banking offices and 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.regions.com.