Our Core Purpose: FCLF exists to maximize opportunities for people and places outside of the economic mainstream.

Our Core Purpose: FCLF exists to maximize opportunities for people and places outside of the economic mainstream.

What does this mean? That every loan we make at FCLF brings high social impact to its low-income community and the residents of that community. If a project does not target low-income individuals or aid in economic redevelopment, it does not receive financing from FCLF.

We help capital flow in new and better ways for people and places that we exist to serve. Our goal is to help organizations build, acquire and rehab projects – ultimately, to help people and build strong communities. We believe a community is defined by its components: housing, schools, healthcare, grocery stores, local businesses. Our loans help stabilize communities by providing resources to help local non-profit and mission-based for-profit organizations succeed and achieve their missions.

For 25 years FCLF has led capital into Florida's communities through 3 key actions: Connect, Advance, and Unite.

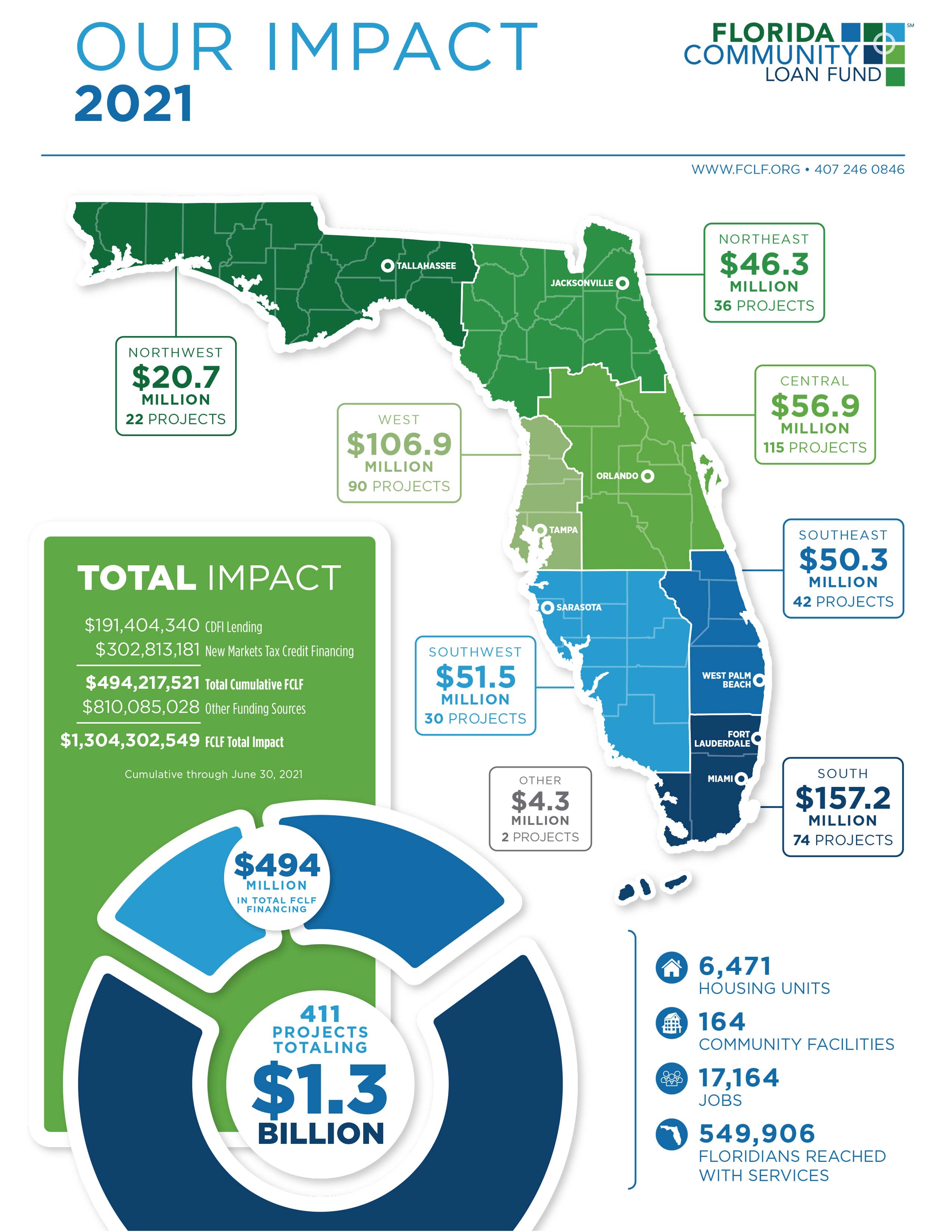

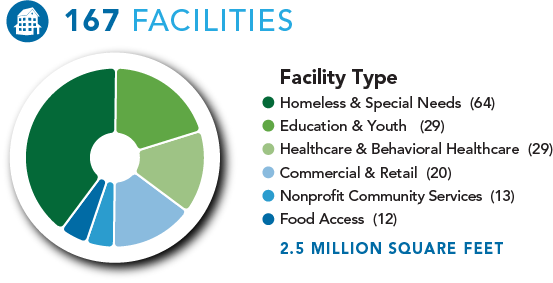

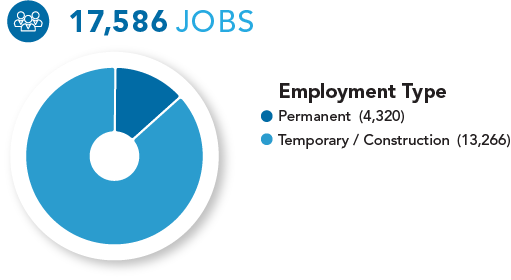

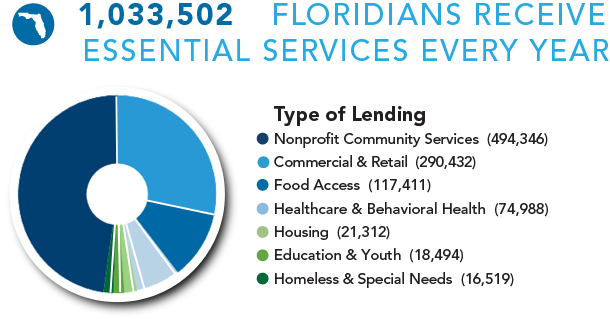

Here are some of the ways we have touched lives and communities through our financing programs.

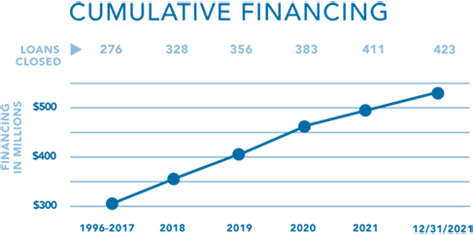

As of December 31, 2021, FCLF has achieved...

$542 million in total financing into projects totaling $1.35 billion in project costs, through

393 loans through its community development lending, and

30 transactions through the New Markets Tax Credit Program.

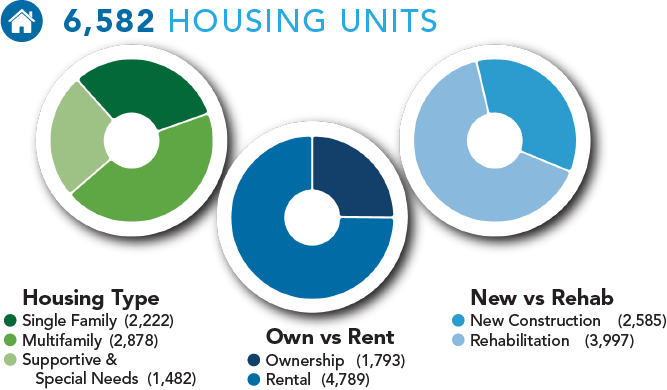

Our borrowers provide affordable housing, for sale and rent, to households that meet low-income criteria. As of December 31, 2021, FCLF has financed 6,582 affordable housing units.

In addition to these measurable impacts, FCLF advocacy work aims to improve public policies that:

- affect the operating environment in which our borrowers work,

- create opportunities for increasing the capacity for non-profit developers, and

- promote transparent accountable strategies for increasing the flow of capital for community and economic development in low- and moderate-income communities.

Our efforts include educating state and federal elected officials on the role of Community Development Financial Institutions (CDFIs) as important intermediary institutions with the capacity to leverage state and federal dollars to achieve greater impact.

To read more about organizations we have financed, we invite you to Meet Our Borrowers. Our Impact report also has more information on our financing throughout Florida.

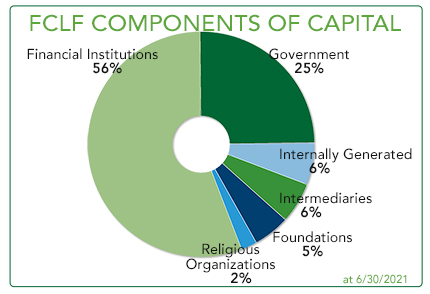

Here is a snapshot of FCLF's Components of Capital at June 30, 2021, our most recent fiscay year-end:

Here is a snapshot of FCLF's Impact throughout Florida as of June 30, 2021, our most recent year-end. You can download the full Our Impact brochure from our Downloads page.